Your Shopping Cart Is Empty

| Report Code: A74587 | Pages: 400 | May 2023 | 48 Views | ||

| Author(s) : Yamini P , Yerukola P | Tables: 217 | Charts: 80 |

| |

The global grey hydrogen market was valued at $131.8 billion in 2022 and is projected to reach $174.9 billion by 2032, growing at a CAGR of 2.9% from 2023 to 2032.

Key Report Highlighters:

The grey hydrogen market is not directly impacted by the ongoing Russo-Ukrainian war. However, there is an increased focus on diversification, energy security, and the development of sustainable alternatives such as green hydrogen, renewable energy, and blue hydrogen technologies. This is expected to negatively impact the market growth for grey hydrogen.

Grey hydrogen is produced from combustion of coal and reformation of natural gas. Grey hydrogen fulfills almost 94% of hydrogen demand followed by blue and green hydrogen. It is the cheapest way of producing hydrogen. However, it releases around 11 kg of CO2 for every 1kg of hydrogen produced and thus, is a big contributor to carbon emissions and environmental pollution.

Hydrogen is abundant in nature. It can be produced through sources such as fossil fuels, natural gas such as methane, hydrocarbons, renewable sources, and electrolysis, which is by separating water molecules. Based on the production method, hydrogen can be grey, black/brown, blue, green, or pink. Grey hydrogen is generated from fossil fuels such as natural gas or methane. During this production, no carbon emissions are captured and there is an estimated leakage of around 1.5% methane.

For black/brown hydrogen, black coal or lignite is used for producing hydrogen which has maximum damage to the environment. According to the World Bank, the demand for hydrogen reached an estimated 87 million metric tons (MT) in 2020 and is expected to grow to 500–680 million MT by 2050. The hydrogen production market was valued at $130 billion and is estimated to grow by 9.2% per year through 2030. Hydrogen is entirely supplied from fossil fuels, with 6% of global natural gas and 2% of global coal used for hydrogen production. As a consequence, the production of hydrogen is responsible for carbon dioxide (CO2) emissions of around 830 million tons of carbon dioxide per year (MtCO2/year).

Hydrogen is considered a main component for energy economy. Hydrogen is used as feedstock in many industrial processes, metallurgical, and chemical processes. It can be used in fuel cell technology where it is used for producing heat, electricity, and water. It also has several applications in the transportation industry. The growing potential for hydrogen demand acts as a major driving factor for grey hydrogen market growth. Hydrogen is also majorly used to produce ammonia, of which 80% is used for fertilizers production. This also contributes to the growth of the grey hydrogen industry. However, the high carbon dioxide emissions in the production process when compared to other fuels restrain the grey hydrogen market growth. As hydrogen is highly volatile and inflammable, extensive safety procedures need to be followed, which further adds to the final cost of grey hydrogen and thus acts as a market restraint.

Market Dynamics

Commercial viability of grey hydrogen depends on several factors, including the cost of production, the demand for hydrogen, and the availability of infrastructure to transport and store hydrogen. Technological advancements in grey hydrogen production, such as improved SMR processes or the development of new production methods, can reduce the cost of production and improve the commercial viability of grey hydrogen. Overall, the commercial viability of grey hydrogen depends on a combination of economic, regulatory, and technological factors, as well as the demand for hydrogen in various applications. As these factors continue to evolve, so will the commercial viability of grey hydrogen.

The global demand for energy is expected to continue to increase, particularly in developing countries. Grey hydrogen is an established and reliable source of energy that can help meet this demand. Grey hydrogen is widely used in various industrial processes, including oil refining, chemical production, and metal production. As these industries continue to grow, the demand for grey hydrogen is expected to increase. Hydrogen has been used in several industries as feedstock, reducing agents, removing impurities from ores, producing ammonia gas for fertilizers, and many more. However, potential applications of the product such as in building heating & cooling, aviation, shipping, iron & steel, chemicals, and hydrogen-based fuels augment the grey hydrogen market growth to meet the rising demand.

The hydrogen economy faces many challenges as there is a broad spectrum of hydrogen production methods with varied carbon emissions quantity. There is no defined standard or bar set for regulating and governing the market. Moreover, international hydrogen trade is also not regulated and is not encouraged at a large scale. These factors restrain the market growth for grey hydrogen.

Grey hydrogen production can be expensive due to the energy-intensive process of steam methane reforming. The cost of hydrogen can also be affected by the price of natural gas and the cost of carbon credits, which can make it less competitive than other fuels or hydrogen production methods. The increasing demand for cleaner fuels has led to the development of alternative hydrogen sources, such as green hydrogen, which is produced using renewable energy sources. These alternative sources may become more competitive with grey hydrogen over time, affecting the demand and growth of the grey hydrogen market.

The grey hydrogen market size is studied on the basis of source, production method, application, and region.

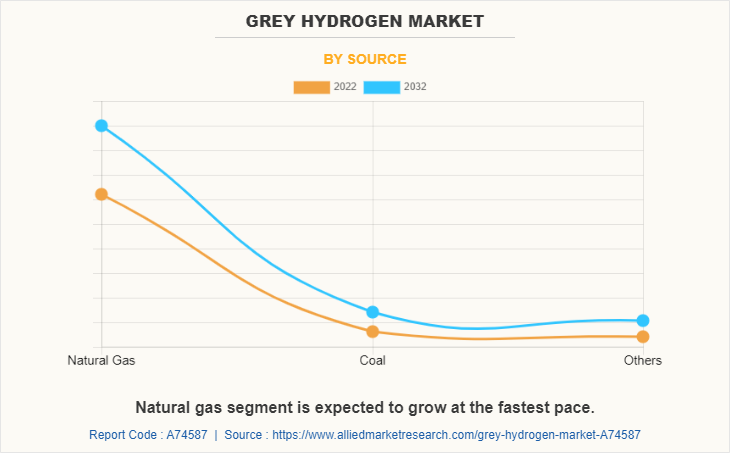

By source, the grey hydrogen market is divided into natural gas, coal, and others. The natural gas segment dominated the grey hydrogen market share for 2022. Grey hydrogen is produced through steam reforming of natural gas. Majorly, methane is used for producing hydrogen. Grey hydrogen is primarily produced from natural gas through a process called steam methane reforming (SMR). The SMR process involves reacting natural gas with high-temperature steam to produce hydrogen and carbon monoxide (CO). The CO is then reacted with more steam to produce additional hydrogen and carbon dioxide (CO2). The overall reaction can be represented as follows:

CH4 + H2O → CO + 3H2

CO + H2O → CO2 + H2

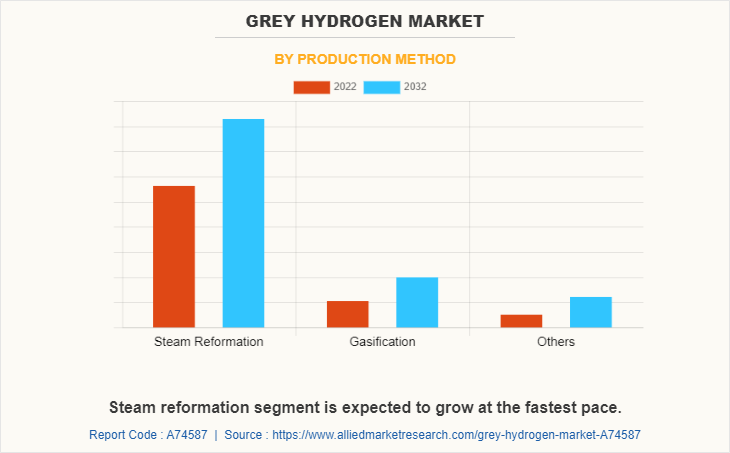

Depending on the production method, the market is further classified into steam reformation, gasification, and others. The steam reformation segment is expected to dominate the grey hydrogen market forecast period. Steam reforming (SMR) is the most common method for producing grey hydrogen, which involves reacting natural gas with steam in the presence of a catalyst to produce hydrogen and carbon monoxide. The resulting mixture, known as synthesis gas or syngas, is then further processed to remove impurities and separate the hydrogen from the carbon monoxide.

According to data from the International Energy Agency (IEA), in 2019, approximately 75 million tons of hydrogen were produced globally, with 95% of this production coming from SMR. The majority of this hydrogen was used in industrial processes, with the remaining hydrogen being used for transportation, power generation, and other applications.

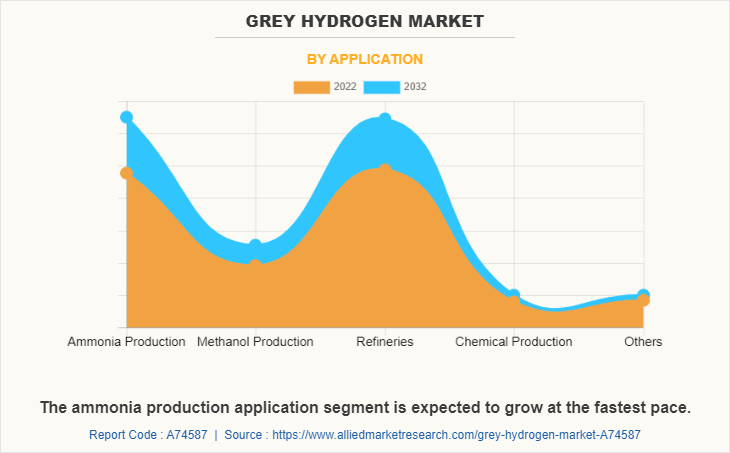

By application, the market is divided into ammonia production, methanol production, refineries, chemical production, and others. The Haber-Bosch process is commonly used to produce ammonia, which involves combining nitrogen gas with hydrogen gas to produce ammonia. Grey hydrogen is often used as the source of hydrogen in the Haber-Bosch process, as it is more cost-effective than using green hydrogen produced through renewable sources. The grey hydrogen used in the process is typically produced through steam methane reforming (SMR) of natural gas or other fossil fuels. Ammonia produced using grey hydrogen has similar characteristics to ammonia produced using green hydrogen. It can be used in the same industrial applications and as a fertilizer. However, the production of grey hydrogen generates significant carbon emissions, which contribute to climate change.

By region, the grey hydrogen market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is a large consumer of electric vehicles, which drives the demand for hydrogen fuel cells. China dominated the global hydrogen market being the largest producer as well as consumer of the product. China consumes around 24 million tons of hydrogen annually. The rise in demand for grey hydrogen in building & construction, manufacturing plants, automobiles, and electric vehicle drives the demand for grey hydrogen. In 2017, Japan became the first country to formulate a national hydrogen strategy as part of its ambition to become the world’s first “hydrogen society” by adopting fuel across all sectors. South Korea is planning for hydrogen to provide 10% of the energy needs of its cities, counties, and towns by 2030, with its share rising to 30% by 2040.

The major players operating in the grey hydrogen industry are Linde plc, Air Liquide, Orsted A/S, Iberdrola SA, Air Products & Chemicals, Inc., Indian Oil Corporation Ltd., Reliance Industries, China National Petroleum Corporation, Exxon Mobil Corporation, and Messer Group GmbH.

Grey Hydrogen Market Report Highlights

| Aspects | Details |

|---|---|

| Market Size By 2032 | USD 174.9 billion |

| Growth Rate | CAGR of 2.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| Source |

|

| Production Method |

|

| Application |

|

| By Region |

|

| Key Market Players | Messer Group, Air Liquide, Iberdrola S.A., Orsted A/S, Exxon Mobil Corporation, Reliance Industries Ltd - (RIL) India, Linde plc, Air Products & Chemicals Inc., China National Petroleum Corporation, Indian Oil Corporation Limited |

Analyst Review

According to the insights from the CXO’s, hydrogen is projected to contribute around 15-17% to the energy mix by 2050. The grey hydrogen market is driven by the growing demand for energy, increasing industrial applications, transportation needs, and the development of new technologies and solutions. While there are challenges and restraints facing the market, there are also significant opportunities for growth and development. However, the grey hydrogen market is facing several challenges and restraints, including environmental concerns, cost, infrastructure, competition from other hydrogen sources, and safety concerns. These challenges may limit the growth of the grey hydrogen market and drive the development and adoption of cleaner alternatives such as green hydrogen

Loading Table Of Content...

A. The estimated industry size of Grey Hydrogen is $171.9 billion by 2032.

A. Increased commercial viability, growth in energy demand and industrial applications, rise in demand for hydrogen as alternative fuels, and rise in demand for hydrogen from the transportation sector are the upcoming trends in the grey hydrogen market.

A. Ammonia Production is the leading application of Grey Hydrogen Market.

A. Asia-Pacific is the largest regional market for Grey Hydrogen.

A. Linde plc, Air Liquide, Orsted A/S, Iberdrola SA, Air Products & Chemicals, Inc., Indian Oil Corporation Ltd., Reliance Industries, China National Petroleum Corporation, Exxon Mobil Corporation, and Messer Group GmbH are the top companies to hold the market share in Grey Hydrogen.

Start reading instantly.

This Report and over 52,906+ more Reports, Available with Avenue Library. T&C*.

Enterprise

License/PDF

Library

Membership

*Taxes/Fees, if applicable will be added during checkout. All prices in USD

To ensure high-level data integrity, accurate analysis, and impeccable forecasts

For complete satisfaction

On-demand customization of scope of the report to exactly meet your needs

Targeted market view to provide pertinent information and save time of readers

Get insights on topics that are crucial for your business. Stay abreast of your interest areas.

Get Industry Data AlertsTo ensure high-level data integrity, accurate analysis, and impeccable forecasts

For complete satisfaction

On-demand customization of scope of the report to exactly meet your needs

Targeted market view to provide pertinent information and save time of readers