Your Shopping Cart Is Empty

| Report Code: A31434 | Pages: 368 | Oct 2022 | 2864 Views | ||

| Author(s) : Pradeep R , Vineet K | Tables: 173 | Charts: 67 |

| |

The global syndicated loans market was valued at $1018.7 billion in 2021, and is projected to reach $3798.4 billion by 2031, growing at a CAGR of 14.2% from 2022 to 2031.

The COVID-19 had a negative impact on the syndicate loans market outlook attributing to the fact that no big projects such as development of infrastructures, corporate deals, or government projects were undertaken during the lockdown period, as there was shortage of man force to work on these projects, as well as the lenders were already facing huge losses, as market was down due to COVID-19.

A syndicated loan is a financing offered by a group of lenders referred to as a syndicate who work together to provide funds for a single borrower. The borrower can be a corporation, a large project, or a sovereign government. The loan can involve a fixed amount of funds, a credit line, or a combination of the two. In addition, syndicated loans arise when a project requires too large loan for a single lender or when a project needs a specialized lender with expertise in a specific asset class. Syndicating the loan allows lenders to spread risk and take part in financial opportunities that may be too large for their individual capital base.

The demand for syndicate loans is experiencing growth due to requirement of huge amount of funds by the borrowers. It is generally difficult for a single lender to give loan for such big amount and therefore syndicate loan demand is growing among both the borrowers and lenders. In addition, syndicate loan helps to equally distribute the risk sharing among all the lenders which reduces the burden of the lender, in case the borrower is unable to repay back the loan amount. These are some of the factors propelling the growth of syndicated loans market. However, there are high chances of a syndicate personal loan becoming a bed debt, as such huge amount is difficult to be repaid by the buyer and if the project fails for which the loan was taken, then the lenders have to face the loss. Therefore, lenders hesitate to lend money for syndicate loans. Thus, this is a major limiting factor for the syndicated loans market. On the contrary, there are a large number of megaprojects being developed, such as construction of dams, road infrastructures, buildings and others for which a large sum of money is required. Syndicate leveraged finance are very useful in these cases as they finance such projects easily. Therefore, the large-scale development of megaprojects is expected to provide lucrative opportunities for the syndicated loans market growth in the coming years.

The report focuses on growth prospects, restraints, and trends of the syndicated loans market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the syndicated loans market share.

The syndicated loans market is segmented into Type, Use of Proceeds and Industry Vertical.

Segment review

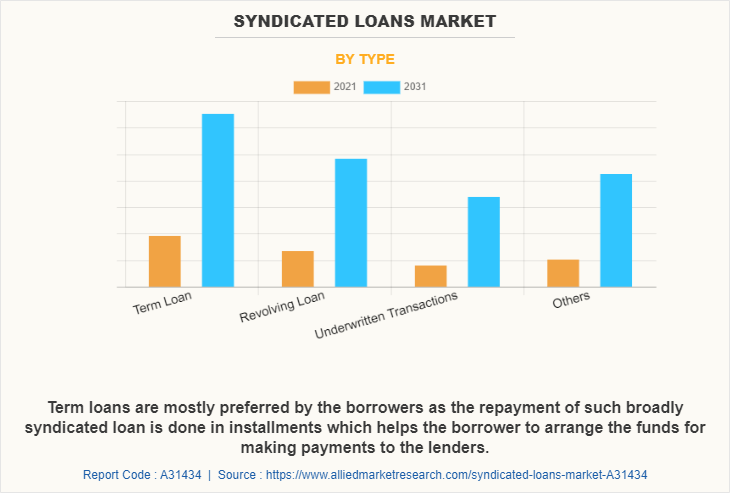

The syndicated loans market is segmented on the basis of type, use of proceed, industry vertical and region. By type, it is segmented into term loan, revolving loan, underwritten transactions, and others. The term loan is further bifurcated into fixed-rate, floating-rate, and others. By use of proceed, it is bifurcated into working capital, acquisition financing, project finance, and others. By industry vertical, it is segregated into financials services, energy and power, high technology, industrials, consumer products and services, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the term loan segment attained the highest growth in 2021 in the syndicated loans market. This is attributed to the fact that term loans are mostly preferred by the borrowers as the repayment of such broadly syndicated loan is done in installments which helps the borrower to arrange the funds for making payments to the lenders. Furthermore, in case they are availed for a longer duration, term loans are offered at lower interest rates than those with a shorter term. Moreover, the interest rates are fixed, and do not vary during the loan’s lifetime. Moreover, term loans offer a great deal of flexibility, from the duration to the principal and interest rate, there is scope for a lot of negotiation.

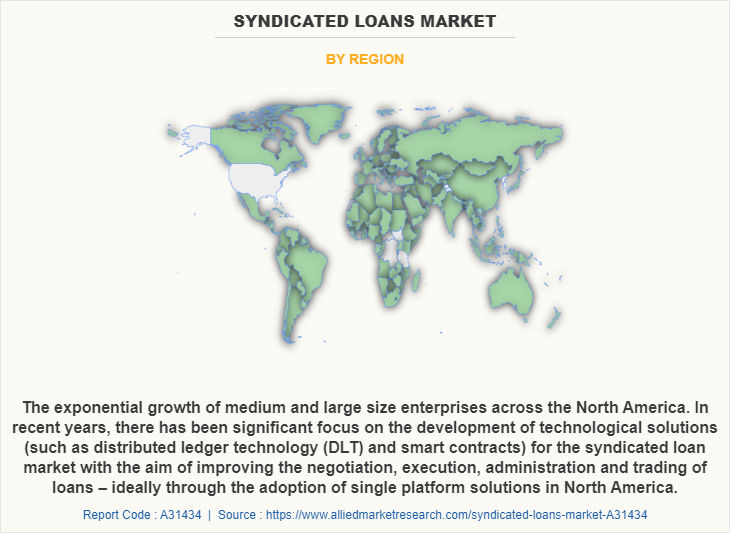

By region, North America attained the highest growth in 2021. This is attributed to the rise in the exponential growth of medium and large size enterprises across the North America. In recent years, there has been significant focus on the development of technological solutions (such as distributed ledger technology (DLT) and smart contracts) for the syndicated loan market with the aim of improving the negotiation, execution, administration and trading of loans – ideally through the adoption of single platform solutions in North America.

The report analyzes the profiles of key players operating in the syndicated loans market such as Acuity Knowledge Partners, Bank Handlowy w Warszawie S.A., Bank of China (BOC), Bank of the West, Capital One, CLAAS Group, EBRD, JPMorgan Chase & Co., Mizuho Bank, Ltd., Mitsubishi UFJ Financial Group, Inc., PT Bank BTPN Tbk, State Bank of India, The SILC Group, Truist, Union Bank of India., AXYON.AI, and HubX. These players have adopted various strategies to increase their market penetration and strengthen their position in the syndicated loans market.

COVID-19 impact analysis

The COVID-19 had a negative impact on the syndicated loans market outlook attributing to the fact that no big projects such as development of infrastructures, corporate deals, or government projects were undertaken during the lockdown period, as there was shortage of man force to work on these projects, as well as the lenders were already facing huge losses, as market was down due to COVID-19. Moreover, lenders were not ready to invest in any big ticket projects as the chances of losses were higher. Thus, the syndicated loans industry was negatively impacted due to COVID-19 pandemic.

Top impacting factors

Surge in demand for large loans

Loan syndication allows borrowers to borrow large amounts to finance capital-intensive projects. A large corporation or government can borrow a huge loan to finance large equipment leasing, mergers, and financing transactions in telecommunications, petrochemical, mining, energy, transportation, and others. In addition, a single lender would be unable to raise funds to finance such projects, and therefore, bringing several lenders to provide the financing makes it easy to carry out such projects. Moreover, as there are development projects being undertaken by private players as well as by the government, the demand for syndicated loans is rapidly growing. This is a major propelling factor for the growth of the market.

Risk is shared equally among lenders

In case of a syndicate loan, there is a group of lenders that finance a borrower and therefore, the risk sharing ratio is equally distributed among the lenders according to the percentage of finance they lend. Thus, lenders do not have to fear about incurring huge losses in case the loan turns into bad debt. Furthermore, since a syndicate online loan is contributed to by multiple lenders, the loan can be structured in different types of loans and securities. The varying loan types offer different types of interest, such as fixed or floating interest rates, which makes it more flexible for the borrower. Also, borrowing in different currencies protects the borrower from currency risks resulting from external factors such as inflation and government laws and policies. This is a major growth factor for the syndicated loans industry.

Risk of bad debts

As syndicated loans tend to be much larger than standard bank loans, the risk of even one borrower defaulting could affect each lender participating in the loan. Furthermore, as these loans are mostly used for undertaking big projects, there are chances that the project is put on hold for some emergencies such as legal dues, public outrage, government orders and others. If these situation arises, the lenders have to face heavy losses as their money is stuck with the borrower for a long period of time which may eventually turn as bad debt. Therefore, lenders mostly hesitate to finance in a syndicated loan which hampers the growth of the market.

Development of megaprojects

As countries are rapidly growing, there is a significant growth in the infrastructure development of the countries. Infrastructural growth such as development of highways, flyovers, dams, and others play a major role in the growth of a country’s GDP. Besides this, corporate deals, government megaprojects, and private constructions require huge financing which can be availed by taking a syndicated loan, as these megaprojects are worth billions, a single lender cannot afford to pay such huge financing. Therefore, as a country undertakes the development of a megaproject in any sector, they will require syndicate loans for financing the project. Hence, this factor is expected to provide major lucrative opportunities for the growth of the syndicated loans market size in the upcoming years.

Key benefits for stakeholders

Syndicated Loans Market Report Highlights

| Aspects | Details |

|---|---|

| Market Size By 2031 | USD 3798.4 billion |

| Growth Rate | CAGR of 14.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 368 |

| Type |

|

| Use of Proceeds |

|

| Industry Vertical |

|

| By Region |

|

| Key Market Players | Acuity, Bank Handlowy w Warszawie S.A., Bank of China, Bank of the West (BNP Paribas), BTPN, Capital One, CLAAS Group, EBRD, JP Morgan & Chase, Mizuho Bank, Ltd., MUFG, State Bank of India, The SILC Group, Union Bank of India |

Loading Table Of Content...

A syndicated loan is a substantial loan provided to a large borrower by several lenders together. Each lender in the lending group (syndicate) provides part of the total amount and shares part of the lending risk. Usually, one lender acts as agent, lending more of the overall amount than the other participants and administering the loan on behalf of the syndicate. A syndicated loan may combine multiple loan types such as fixed-rate, floating-rate, operating, demand, with different repayment terms. The full amount could also be offered in several pieces known as tranches. Loan syndication is often used in corporate financing, as firms seek corporate loans for a variety of reasons, including funding for mergers, acquisitions, buyouts, and other capital expenditure projects. These capital projects often require large amounts of capital that typically exceed a single lender's resource or underwriting capacity.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on June 2022, Citi and Bank of America, joined by Credit Suisse, Goldman Sachs, JP Morgan, Morgan Stanley, Wells Fargo, and Moody’s Analytics, launched Octaura Holdings (Octaura), an independent company whose goal is to create the first open market electronic trading platform for syndicated loans and collateralized loan obligations (CLOs). Built in collaboration with Genesis Global, the low-code software development platform for financial markets, Octaura aims to provide comprehensive trading solutions with natively integrated data and analytics. The company then plans to expand to other products in the credit market. These strategies are projected to provide major lucrative opportunities for the growth of the syndicated loans market.

Some of the key players profiled in the report include Acuity Knowledge Partners, Bank Handlowy w Warszawie S.A., Bank of China (BOC), Bank of the West, Capital One, CLAAS Group, EBRD, JPMorgan Chase & Co., Mizuho Bank, Ltd., Mitsubishi UFJ Financial Group, Inc., PT Bank BTPN Tbk, State Bank of India, The SILC Group, Truist, Union Bank of India., AXYON.AI, and HubX. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

A. The Syndicated Loans Market will have a CAGR of 14.2%

A. The key players profiled in the syndicated loans market analysis are Acuity Knowledge Partners, Bank Handlowy w Warszawie S.A., Bank of China (BOC), Bank of the West, Capital One, CLAAS Group, EBRD, JPMorgan Chase & Co., Mizuho Bank, Ltd., Mitsubishi UFJ Financial Group, Inc., PT Bank BTPN Tbk, State Bank of India, The SILC Group, Truist, Union Bank of India., AXYON.AI, and HubX.

A. North America is the largest regional market for the Syndicated Loans Market.

A. The estimated industry sized of Syndicated Loans Market is $3,798.40 billion.

A. Acuity Knowledge Partners, Bank of China (BOC), CLAAS Group, EBRD and Bank of the West. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Start reading instantly.

This Report and over 52,906+ more Reports, Available with Avenue Library. T&C*.

Enterprise

License/PDF

Library

Membership

*Taxes/Fees, if applicable will be added during checkout. All prices in USD

To ensure high-level data integrity, accurate analysis, and impeccable forecasts

For complete satisfaction

On-demand customization of scope of the report to exactly meet your needs

Targeted market view to provide pertinent information and save time of readers

Get insights on topics that are crucial for your business. Stay abreast of your interest areas.

Get Industry Data AlertsTo ensure high-level data integrity, accurate analysis, and impeccable forecasts

For complete satisfaction

On-demand customization of scope of the report to exactly meet your needs

Targeted market view to provide pertinent information and save time of readers